What is Shares Outstanding?

Shares outstanding refers to a company’s stock currently owned by all its shareholders in the public domain but does not include treasury stock or shares repurchased by the company. There are two types of outstanding shares, basic and diluted, both of which are critical in financial statements. The number of outstanding shares is listed on a company’s balance sheet as “capital stock” and is reported on a company’s quarterly filings with the US Securities and Exchange Commission. It is used in calculating a company’s market capitalization, earnings per share (EPS), and cash flow per share (CFPS).

A company’s outstanding shares can fluctuate for many reasons. The number will increase if a company issues additional shares when they raise capital through financial instruments, such as equity financing and employee stock options (ESO), but will decrease if a company buys back its shares through a share repurchase program.

What is the Difference Between Basic and Diluted Shares Outstanding?

Basic and diluted shares outstanding are both used to measure the quantity of stock issued by a company by utilizing various methodologies. Basic shares represent the total number of common shares that are outstanding as of the reporting date, and diluted shares are the total number of shares that would be outstanding if all sources of conversion, such as convertible bonds and ESO, are exercised. The number of shares is important in the calculation of a company’s EPS. For instance, using diluted shares will increase the number of shares used in the calculation, which will reduce the dollars earned per share of common stock.

What are Employee Stock Options (ESO)?

In general terms, employee stock options (ESO) are a form of equity compensation. A company can grant them to employees, contractors, consultants, and investors. ESOs are contracts that grant employees the right to buy a set number of shares of the company stock at a pre-set price and period of time. A company may issue ESOs to provide employees with an incentive to work towards growing the value of the company’s shares and serve as an incentive for employees to stay with the company.

What is Earnings Per Share (EPS)?

Earnings per share (EPS) is a measure of the total dollar amount of earnings a public company generates per share of common stock. It is calculated as a company’s net income divided by the outstanding shares of its common stock. A more refined calculation adjusts for shares that could be created through options, convertible debt, or warrants. To calculate a company’s EPS, the balance sheet and income statement are utilized to find the number of common shares at the end of the period, any dividends paid on preferred stock, and the net income or earnings. Many analysts consider this ratio to be the key indicator of a company’s value; the higher a company’s EPS, the more profitable it is considered. Furthermore, there are two kinds of EPS: basic EPS and diluted EPS.

What is The Difference Between Basic and Diluted Earnings Per Share?

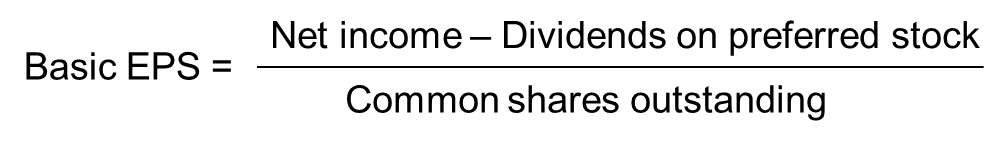

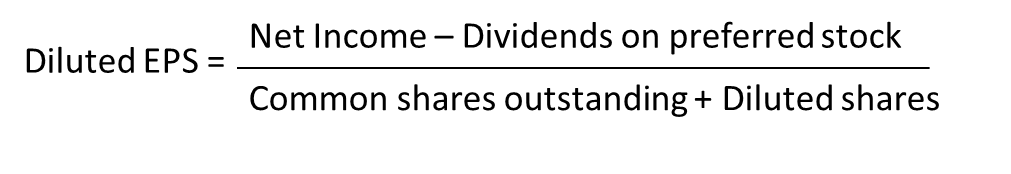

Basic and diluted EPS are both measures of profitability of a company. Basic EPS measures how much a company earns per share by dividing the net income minus the preferred dividend with the number of outstanding equity shares, while diluted EPS takes into account convertible securities, such as convertible preferred shares, ESOs, debt, and equity, to calculate EPS. Another difference is that basic EPS is considered a simple measure of profitability while diluted EPS is a more complex measure. Although basic EPS is the most suitable, it is not a very accurate approach to determine how a company is doing financially; diluted EPS is a much better and more accurate approach to use. The last key difference is the fact that basic EPS is always higher than diluted EPS due to the diluted EPS’s consideration of all convertible securities in its total number of common shares.

How to Calculate Basic EPS

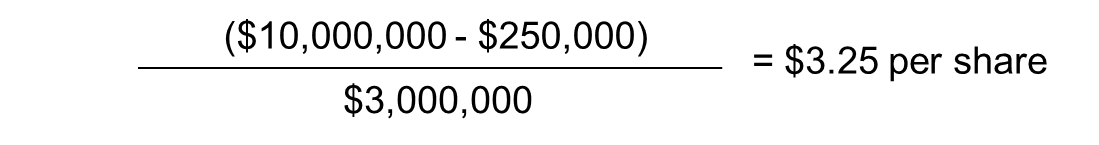

Assume Company XYZ had a net income of $10 million over the last fiscal year and paid $250,000 in dividends, and has common shares outstanding of $3 million.

Using the Basic EPS Equation:

Company XYZ’s Resulting Basic EPS is:

How to Calculate Diluted EPS

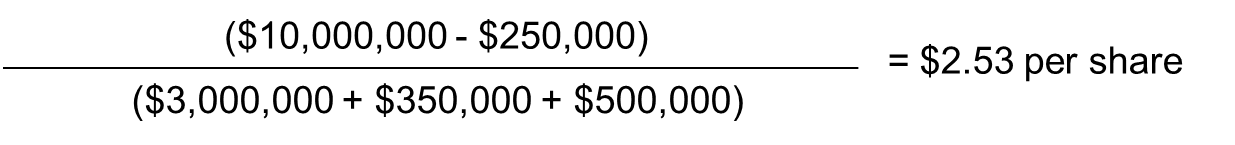

Assume Company XYZ has ESOs that could be converted to $350,000 in common shares and convertible preferred shares that could be converted to $500,000 in common shares.

Using the Diluted EPS Equation:

Company XYZ’s Resulting Diluted EPS is:

Why are Shares Outstanding and EPS Important in Finance?

Both shares outstanding and EPS are critical in the financial world as everyone from CEOs to research analysts are interested in a company’s earnings. Outstanding shares work according to the same economic laws as anything else that can be bought and sold; stock price is determined through supply and demand. Therefore, the value of each share is inversely related to the total number of outstanding shares, with all other things being equal. Similar to price, the percentage of company ownership expressed in each share is also reduced when more shares are created. Outstanding shares are also used as a variable in financial ratios, which makes them essential for financial analysis. When a company issues too many shares too quickly, existing shareholders can be negatively impacted. Ownership levels can be diluted and share prices can drop, which all imply a certain level of risk for issuing more shares.

Knowing the number of shares outstanding can help protect investors and help them to better analyze earnings. To analyze earnings, investors and analysts use the EPS ratio, which allows for a better indication of how much money a company is making for each of its shares and is used to calculate the price-to-earnings (P/E) valuation ratio, in which the E refers to EPS. By dividing a company’s share price by its EPS, an investor can determine the value of a stock in regard to how much the market is willing to pay for each dollar of earnings. EPS also measures a company’s future growth and its overall financial health. In the end, growing earnings depict a profitable company and a solid return for investors.